Nieuws en Hulpbronnen

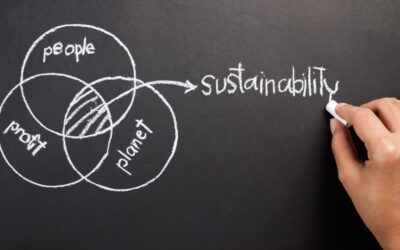

From Regulation to Resilience: Understanding Europe’s Sustainability Shift

After months of uncertainty and stalled implementation, the EU closed 2025 with long-awaited clarity on its sustainability rulebook. In December, the European Parliament and the Council of the European Union reached agreement on amendments to the Corporate...

Update 2026 – Consumer Price Index and Inflation in the Netherlands

The consumer price index (CPI) measures the average change in prices of goods and services purchased by households in the Netherlands. It serves as a key indicator of inflation by showing whether the price of specific products or services has increased or decreased...

Rising Public Demand for Stronger European Action Amid Growing Security Concerns

A growing number of European citizens are expressing concern about security, stability, and geopolitical uncertainty, according to the European Parliament’s latest Eurobarometer survey published in January 2026. The findings suggest an increasing expectation that the...

Strategical Investments in AI from France

France has firmly positioned itself as one of Europe’s most ambitious players in artificial intelligence. From national strategy to industrial deployment, AI is widely viewed as a cornerstone of Industry 4.0 and future competitiveness. Yet, despite massive investment...

Artificial Intelligence in Germany: Between Strategic Ambition and Societal Unease

Germany was among the first countries to recognise the transformative potential of artificial intelligence (AI). In 2018, it demonstrated early vision and leadership by launching a national AI strategy aimed at strengthening both German and European competitiveness,...

Dutch Parties Agree to Form Minority Cabinet After Extended Coalition Talks

The Dutch political parties D66, CDA and VVD have decided to form a new national government as a minority cabinet following months of negotiations after the October 2025 general election. The three parties confirmed their choice to pursue this configuration at the end...