Hulpmiddelen en Nieuws

Blijf op de hoogte van aankomende evenementen, wekelijkse artikelpublicaties over de nieuwste trends en ontwikkelingen

Evenementen

Onze Recente Evenementen

The Netherlands: Europe’s Rising Powerhouse in Quantum Innovation

The Netherlands is rapidly positioning itself as one of the world’s most dynamic quantum technology hubs. Through strong public-private investment, coordinated national strategy, and deep...

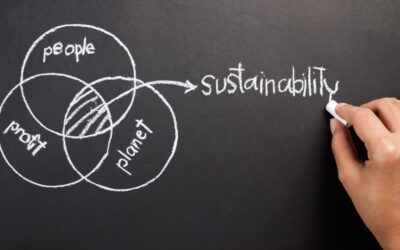

From Regulation to Resilience: Understanding Europe’s Sustainability Shift

After months of uncertainty and stalled implementation, the EU closed 2025 with long-awaited clarity on its sustainability rulebook. In December, the European Parliament and the Council of the...

Update 2026 – Consumer Price Index and Inflation in the Netherlands

The consumer price index (CPI) measures the average change in prices of goods and services purchased by households in the Netherlands. It serves as a key indicator of inflation by showing whether...

Blog

Onze Laatste Artikelen

The Netherlands: Europe’s Rising Powerhouse in Quantum Innovation

The Netherlands is rapidly positioning itself as one of the world’s most dynamic quantum technology hubs. Through strong public-private investment, coordinated national strategy, and deep...

From Regulation to Resilience: Understanding Europe’s Sustainability Shift

After months of uncertainty and stalled implementation, the EU closed 2025 with long-awaited clarity on its sustainability rulebook. In December, the European Parliament and the Council of the...

Update 2026 – Consumer Price Index and Inflation in the Netherlands

The consumer price index (CPI) measures the average change in prices of goods and services purchased by households in the Netherlands. It serves as a key indicator of inflation by showing whether...

Rising Public Demand for Stronger European Action Amid Growing Security Concerns

A growing number of European citizens are expressing concern about security, stability, and geopolitical uncertainty, according to the European Parliament’s latest Eurobarometer survey published in...

Strategical Investments in AI from France

France has firmly positioned itself as one of Europe’s most ambitious players in artificial intelligence. From national strategy to industrial deployment, AI is widely viewed as a cornerstone of...

Artificial Intelligence in Germany: Between Strategic Ambition and Societal Unease

Germany was among the first countries to recognise the transformative potential of artificial intelligence (AI). In 2018, it demonstrated early vision and leadership by launching a national AI...

Dutch Parties Agree to Form Minority Cabinet After Extended Coalition Talks

The Dutch political parties D66, CDA and VVD have decided to form a new national government as a minority cabinet following months of negotiations after the October 2025 general election. The three...

Dutch Tax Reforms in 2026: Modest Income Gains Across the Board

Most people in the Netherlands can expect a small boost to their disposable income in 2026, following a series of adjustments to the income tax system and social contributions. While the increases...

IFRS vs. German GAAP Series: Revenue

IFRS 15 prescribes the accounting for revenue from sales of goods and rendering of services to a customer. The standard applies only to revenue that arises from a contract with a customer and is...

Blog

Wekelijks Gratis Zakelijke Hulpmiddelen

Word lid van onze nieuwsbrief en mis nooit meer een slag! Schrijf u nu in en ontvang wekelijks de nieuwste trends en ontwikkelingen op het gebied van wetgeving, software, technologie en meer, met behulp van een nieuw artikel dat elke week rechtstreeks in uw inbox komt.

We Zijn Hier Om Te Helpen!

Office

Ridderspoorweg 61

1032LL Amsterdam

Hours

Weekdays: 9AM- 6PM

Call Us

+31 (0)20 760 1540

Mail Us

Info@globalconnectadmin.com