In a time of global uncertainty and shifting economic priorities, choosing the right location for foreign direct investment (FDI) is a strategic decision. Two European giants—Germany and the United Kingdom—stand out as leading destinations. Each offers distinct advantages shaped by history, geography, policy, and innovation.

This article explores and compares Germany and the UK as investment locations across six key dimensions: market access, innovation, talent, infrastructure, tax incentives, and sustainability.

- Market Access and Strategic Positioning

Germany, situated in the geographic heart of Europe, holds a powerful position as the gateway to the European Union’s single market of over 450 million people. Its central location allows seamless integration into the supply chains of both Western and Eastern Europe, making it a prime base for businesses with continental ambitions. The country’s reunification history and its role as Europe’s economic engine further reinforce its strategic appeal.

On the other hand, the United Kingdom, after Brexit, has pivoted towards creating specialized Investment Zones. These zones—spread across all four nations of the UK—aim to harness regional strengths and attract investment through tailored sectoral strategies. Although the UK no longer has frictionless access to the EU market, it offers global connectivity through an extensive network of trade agreements and a clear focus on international competitiveness.

- Innovation Ecosystem and R&D Leadership

Germany’s reputation for quality and engineering excellence remains unmatched. The “Made in Germany” brand continues to symbolize precision, durability, and innovation. The country ranks among the global leaders in patent filings, particularly in advanced manufacturing, automotive, and industrial machinery. It is also Europe’s top innovator in biotechnology startups. Germany’s innovation ecosystem is built on close collaboration between government, research institutions, and industry—with foreign investors enjoying equal access to funding and support.

The UK, meanwhile, is recognized as a global innovation hub. It is home to some of the world’s most prestigious universities, including Oxford and Cambridge, and consistently ranks highly in global R&D output. The UK government supports innovation through attractive tax policies such as the Patent Box (which offers a 10% corporate tax rate on profits from patented inventions) and R&D tax credits that allow companies to deduct up to 230% of qualifying expenditure. Initiatives like Innovate UK and the Global Entrepreneur Programme help businesses scale internationally with UK as their base.

- Skills and Talent Availability

A major consideration for investors is the availability of a skilled and adaptable workforce. Germany benefits from a robust dual education system, blending academic education with vocational training. Its workforce is known for technical precision and strong qualifications in engineering, manufacturing, and applied sciences.

The UK, in contrast, offers a highly diverse and internationally competitive labour market. It boasts one of the most educated workforces in Europe, with globally ranked universities feeding talent into industries ranging from fintech to pharmaceuticals. Government-backed apprenticeships, bootcamps, and regional skill strategies ensure a strong pipeline of sector-specific talent, particularly in the newly developed Investment Zones.

- Infrastructure and Digital Readiness

Germany’s logistics and transport infrastructure is among the most advanced in the world. With over 13,000 kilometres of autobahns and 38,000 kilometres of railways, Germany facilitates fast and efficient freight and passenger movement. Its central location enhances its role as Europe’s logistics powerhouse, supporting industries like automotive, chemicals, and machinery.

The UK, while smaller in geographic scale, is investing heavily in modernizing its infrastructure through targeted regeneration. Each Investment Zone includes funding for transport upgrades, digital connectivity, and land development. The UK is also a leader in digital infrastructure, offering some of the fastest broadband networks in Europe and actively supporting emerging sectors such as AI, cybersecurity, and digital media.

- Tax Environment and Investment Incentives

The UK stands out for its investor-friendly tax regime. With a 25% corporate tax rate, the lowest in the G7, it combines transparency with flexibility. Foreign investors benefit from tax-free dividend repatriation, favourable capital allowances, and specific incentives such as the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs), which encourage innovation funding.

Germany’s tax system is more traditional but supports long-term stability. While its tax rates are higher, they finance a high-quality public infrastructure, education, and healthcare system. The government actively promotes investment in green energy, semiconductors, and digital technologies through grants, subsidies, and research funding, creating opportunities aligned with Europe’s strategic goals.

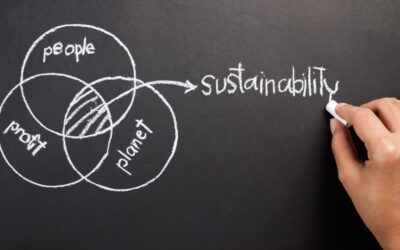

- Sustainability and the Green Economy

Both countries are at the forefront of climate policy and clean growth, albeit with different approaches.

Germany is a key player in the EU’s Green Deal and leads in the adoption of renewable energy, circular economy models, and sustainable industrial practices. The country’s long-standing focus on energy efficiency and its push toward green hydrogen and battery storage is attracting future-oriented investors.

The UK has taken a bold stance with its Net Zero by 2050 law, backed by the Ten Point Plan and Energy Security Strategy. The government aims to mobilize over £100 billion in private investment in clean energy technologies by 2030. Major targets include expanding offshore wind to 50GW, increasing nuclear energy to 24GW, and building a national hydrogen economy. Investment Zones dedicated to green tech are designed to accelerate the clean industrial transition.

Conclusion: Which Country Is Better for You?

Both Germany and the UK are exceptional destinations for foreign investors—but they serve different strategic goals:

- Choose Germany if you seek access to the EU market, top-tier manufacturing and engineering expertise, and a stable logistics platform for continental operations.

- Choose the UK if you prioritize innovation, cutting-edge tech development, favourable tax conditions, and agile, sector-focused investment ecosystems.

In the end, the better choice depends on your industry, risk appetite, and long-term vision.

References

Berlin Partner . (2024). Investing in Germany. Retrieved from Berlin Partner – Business Location Center : https://www.businesslocationcenter.de/en/business-location/berlin-at-a-glance/investing-in-germany

KPMG . (2025). Greenfield/Brownfield Investments and Market Entries in Germany. Retrieved from KPMG : https://kpmg.com/de/en/home/services/investing-in-germany.html

UK Government. (2025). Invest in the UK – UK Investment Zones; UK tax and incentives; UK talent and labour; Clean growth in the UK; UK innovation. Retrieved from UK Government: https://www.great.gov.uk/international/

Photo:

https://th.bing.com/th/id/R.cc3e77be0579dfb477d0f879fa3c8817?rik=FYuwK7x%2b4yx65A&pid=ImgRaw&r=0