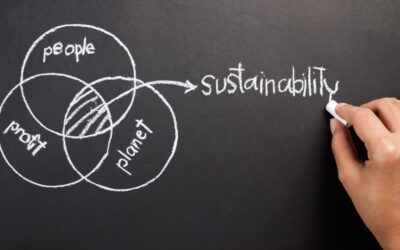

After months of uncertainty and stalled implementation, the EU closed 2025 with long-awaited clarity on its sustainability rulebook. In December, the European Parliament and the Council of the European Union reached agreement on amendments to the Corporate...

XBRL FAQ

March 15, 2022

Related Articles

Update 2026 – Consumer Price Index and Inflation in the Netherlands

The consumer price index (CPI) measures the average change in prices of goods and services purchased by households in the Netherlands. It serves as a key indicator of inflation by showing whether the price of specific products or services has increased or decreased...

Rising Public Demand for Stronger European Action Amid Growing Security Concerns

A growing number of European citizens are expressing concern about security, stability, and geopolitical uncertainty, according to the European Parliament’s latest Eurobarometer survey published in January 2026. The findings suggest an increasing expectation that the...