This week’s article gives a summary of a few topics related to taxation and business regulations updates in The Netherlands in 2024. The 3 topics that will be covered are sustainability reports, equal minimum hourly wage, and CO2 emissions.

Sustainability report for large companies:

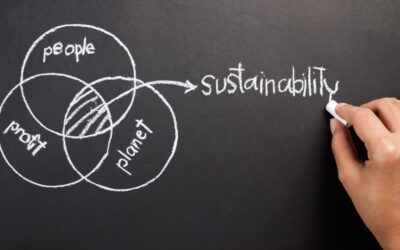

Starting from 2024, all publicly listed companies and large enterprises are mandated to disclose their sustainability policies and performance, a requirement stemming from the European Corporate Sustainability Reporting Directive (CSRD). The European Commission, aiming to bolster transparency on sustainability and other non-financial matters, has proposed a legislative amendment to the Non-Financial Reporting Directive (NFRD), rebranding it as the Corporate Sustainability Reporting Directive.

The CSRD expands the reach of the NFRD by making non-financial transparency obligations applicable to a wider array of companies. Furthermore, the directive calls for the establishment of a standardized reporting framework within the EU, specifying how companies should report on non-financial aspects. In terms of content, the reporting criteria are heightened, and mandatory third-party assurance for non-financial statements is introduced. Key modifications brought about by the CSRD include:

- Extending the legislation’s applicability to all listed companies and large non-listed entities.

- Enhancing and clarifying substantive reporting requirements related to sustainability.

- Enforcing a uniform set of reporting standards across the EU.

- Subjecting sustainability disclosures to (limited) assurance.

- Requiring the digital submission of this information.

Implementation of mandatory reporting will occur gradually, dependent on factors such as company size and activities. The timeline is as follows:

- January 1, 2024: Applicable to companies already subject to the Non-Financial Reporting Directive (NFRD).

- January 1, 2025: Applicable to large companies not previously subject to the NFRD.

- January 1, 2026: Applicable to listed SMEs, small and non-complex credit institutions, and insurance companies.

Medium-sized and small businesses are exempt from the CSRD until at least the financial year 2026. Nevertheless, they may encounter demands from CSRD-compliant customers or suppliers. The CSRD primarily concerns large companies and entrepreneurs engaged in business with such CSRD-compliant entities.

Minimum hourly wage:

Effective January 1, 2024, a statutory minimum hourly wage will be implemented, rendering fixed minimum monthly, weekly, and daily wages obsolete. Employers will be required to pay hourly employees at least the statutory minimum hourly wage from that date onwards. A singular fixed minimum hourly wage will apply to all employees aged 21 and older, while fixed minimum hourly youth wages will be applicable for employees under 21 starting January 1, 2024.

The introduction of the minimum hourly wage necessitates adjustments to agreements in collective labor agreements and employment contracts to align with the new legal framework. Additionally, many organizations may need to modify their payroll systems to accommodate the changes.

Currently, disparity exists, with one employee working 40 hours and another working 36 hours per week, both receiving the same minimum (monthly) wage. The implementation of a fixed minimum hourly wage aims to eliminate such discrepancies, ensuring uniformity across sectors.

Employers have a six-month grace period to prepare for the implementation of the minimum hourly wage. The Ministry of Social Affairs and Employment has compiled a knowledge document containing frequently asked questions and example calculations to assist everyone in adapting to the upcoming changes.

Industry CO2 Tax Implementation

In a bid to prompt companies to reduce their carbon dioxide (CO2) emissions during the production process, a national tax on CO2 emissions in the industrial sector has been in effect since January 1, 2021. The Dutch Emissions Authority (NEa) oversees the implementation of this initiative.

Exemption for Initial Emissions

Initially, companies are granted an exemption for a portion of emissions, providing them with a grace period to adjust their processes. The extent of exempted emissions is initially larger, particularly in the early years, partly due to the impact of the coronavirus crisis. Over time, the exemption diminishes, contributing to the Netherlands’ goal of reducing CO2 emissions by 18.3 megatons by 2030. The CO2 tax for industry applies to:

- Large industrial companies falling under the European Emissions Trading System (EU ETS).

- Waste incineration plants are subject to the EU ETS from January 1, 2028.

- Companies emitting significant amounts of nitrous oxide.

Minimum CO2 Price

If the EU ETS emission allowance price falls below a specified minimum, the CO2 minimum price comes into effect for industry and power stations. This minimum price will be raised from 2024 onwards and adjusted for inflation. As of January 1, 2024, the minimum price stands at €74.17 per ton of CO2 (compared to €55.94 in 2023).

Additional Reduction Goals and Stricter Benchmarks

The government aims to further tighten the CO2 tax by an additional 4 megatons. The reduction factor, determining annual dispensation rights for companies, has been adjusted. Sharper benchmarks within the CO2 tax, effective from 2023, measure the CO2 released per unit of product. These benchmarks, aligned with the EU ETS, ensure that companies work efficiently, while the CO2 tax holds them accountable for excess emissions.

References

AFM. (2023). Sustainability reporting and the Corporate Sustainability Reporting Directive (CSRD). Preluat de pe AFM : https://www.afm.nl/en/sector/themas/duurzaamheid/csrd

Netherlands Enterprise Agency, RVO. (2023). Minimum fee CO2 emissions to increase for industrial companies. Preluat de pe Business.gov.nl: https://business.gov.nl/amendment/co2-emissions-fee-increase/

Netherlands Enterprise Agency, RVO. (2023). Sustainability reports mandatory for large companies. Preluat de pe Business.gov.nl: https://business.gov.nl/amendment/large-companies-must-report-sustainability/

Rijksoverheid. (2023). Milieubelastingen. Preluat de pe Rijksoverheid: https://www.rijksoverheid.nl/onderwerpen/milieubelastingen/co2-heffing-voor-industrie

Rijksoverheid. (2023, July 07). Minimum hourly wage takes effect on January 1, 2024. Preluat de pe Rijksoverheid: https://www.rijksoverheid.nl/actueel/nieuws/2023/07/07/minimumuurloon-gaat-in-op-1-januari-2024

Photo:

https://c1.staticflickr.com/7/6056/6355404323_cf97f9c58e_b.jpg